alphabet stock analysis

Alphabet Inc. (GOOG), the parent company of Google, stands as a formidable tech conglomerate with a vast array of products and services that touch nearly every aspect of our digital lives. From search and advertising to cloud computing and autonomous vehicles, Alphabet’s diverse portfolio has made it one of the most valuable companies globally. But is Alphabet stock still a smart investment for 2024 and beyond? This comprehensive Alphabet stock analysis delves into the company’s past, present, and future, examining its return on equity (ROE), competitive landscape, recent developments, and growth prospects to help you make informed investment decisions.

Alphabet’s Evolution: From Search Engine to Tech Powerhouse

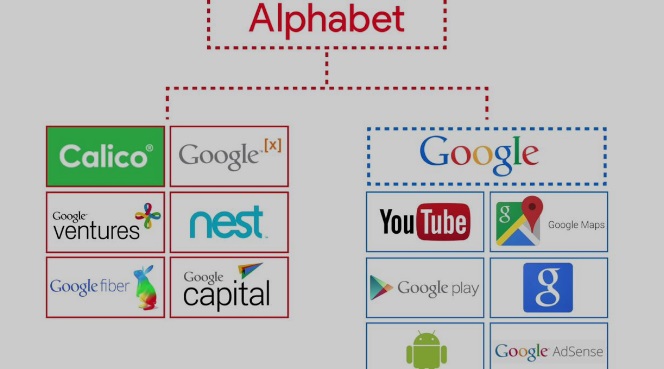

Founded in 1998 as Google, the company quickly became the world’s leading search engine. Over the years, Google expanded into various areas, including advertising, cloud computing, artificial intelligence, and hardware. In 2015, Google restructured itself as Alphabet, a holding company with various subsidiaries, including Google, Waymo (autonomous vehicles), Verily (life sciences), and Calico (biotechnology). This strategic evolution has positioned Alphabet as a leader in the tech industry.

Alphabet’s Financial Performance: 10-Year ROE History

| Year | Return on Equity (%) |

|---|---|

| 2023 (TTM) | 21.74 |

| 2022 | 25.65 |

| 2021 | 30.45 |

| 2020 | 20.46 |

| 2019 | 18.88 |

| 2018 | 15.44 |

| 2017 | 15.61 |

| 2016 | 14.19 |

| 2015 | 13.94 |

| 2014 | 14.82 |

Alphabet’s ROE has remained consistently high over the past decade, reflecting the company’s strong profitability and efficient use of capital. This consistent performance reinforces the attractiveness of Alphabet stock for investors.

Alphabet vs. Competitors: Leading the Tech Race

In the realm of Alphabet stock analysis, it’s essential to understand the competitive landscape. Alphabet faces competition across various sectors, including:

- Search and Advertising: Competing with Microsoft (Bing) and Amazon (advertising)

- Cloud Computing: Rivals include Amazon Web Services (AWS) and Microsoft Azure

- Autonomous Vehicles: Competing against Tesla, General Motors, and Ford

- Smart Home: Facing competition from Amazon (Alexa) and Apple (HomeKit)

Despite the competitive pressures, Alphabet’s dominant position in search and advertising, along with its growing cloud business and innovative projects, positions it as a leader in the tech industry.

Alphabet’s Growth Drivers: Cloud, AI, and Advertising

Several key factors are driving Alphabet’s growth, which is crucial for any Alphabet stock analysis:

- Cloud Computing: The Google Cloud Platform (GCP) is experiencing rapid growth, fueled by increasing demand for cloud infrastructure and services.

- Artificial Intelligence: Alphabet is at the forefront of AI research and development, with applications in search, advertising, and various other areas.

- Advertising: Google’s advertising business, encompassing search, display, and YouTube ads, remains the company’s primary revenue generator.

- Other Bets: Alphabet’s “Other Bets” segment, which includes Waymo, Verily, and Calico, represents long-term growth potential.

Investing in Alphabet Stock in 2024: Pros and Cons

When considering an investment in Alphabet, it’s important to weigh the pros and cons:

Pros:

- Dominant Market Position: Alphabet holds a leading position in search, advertising, and mobile operating systems.

- Growth Potential: Investments in cloud computing, AI, and other bets offer significant growth opportunities.

- Strong Financial Performance: High ROE and consistent profitability make Alphabet stock an attractive investment.

- Innovation: Alphabet is renowned for its innovative culture and cutting-edge technologies.

Cons:

- Regulatory Scrutiny: Alphabet faces antitrust investigations and regulatory challenges in various markets.

- Competition: The tech industry is highly competitive, with rivals constantly pushing the boundaries of innovation.

- Economic Uncertainty: Global economic conditions could impact advertising revenue.

Conclusion: Alphabet Stock Analysis – A Solid Investment with Growth Potential

In summary, this Alphabet stock analysis highlights the company’s diverse portfolio, strong financial performance, and unwavering focus on innovation, making it a compelling investment opportunity. While investors should be aware of the regulatory and competitive challenges, Alphabet’s potential for growth in the evolving tech landscape is undeniable.